When politicians vote to impose or raise minimum wages, they put poor people out of work and INCREASE poverty. No one has ever calculated how many economic studies establish the correlation between minimum-wage laws and unemployment rates. But the number is in the many dozens and probably in the hundreds. Minimum wage laws have done …

Category: Government’s War on the Poor

Mar 31

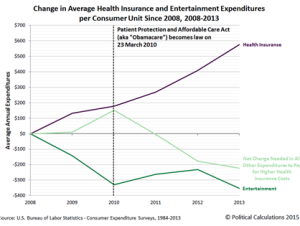

The Data Are In: Increased Government Role in Health Care Leads to Lower Quality of Life For Most Americans

We all know health care prices have increased faster than the rate of inflation every year for more than 40 years, due to Medicare, Medicaid (and in the past couple years), the “Affordable Care Act.” Such government enactments increase demand without increasing supply, causing prices to rise. If markets were allowed to be free, health …

Mar 24

The “Scariest Chart in the World”: After Decades of Government Anti-Saving Policies, Half of Americans Save Nothing

The Business Insider is out with a chart showing that almost half of all Americans (47 %) save nothing and live paycheck to paycheck in response to decades of government policies that punish savers. Chief among the government’s anti-saver policies is the Federal Reserve system, which has set interest rates artificially low for more than …

Mar 24

Urban Institute: Social Security Transfers Wealth From Poor to Rich

A 2004 study by C. Eugene Steuerle, Adam Carasso and Lee Cohen of the Urban Institute, entitled “How Progressive is Social Security and Why?,” found that Social Security is a massive transfer from poor groups to rich Americans. Although “Social Security was designed to redistribute income from those with higher lifetime earning to thos with …

Mar 23

FBI Agents Are Now Paid More than Doctors or Lawyers

Trusters of government can often be heard griping about the “one percent.” Often, these delusional government trusters call for more government; more government regulators of industry, more laws and regulations to control businesses, and slave-plantation-level taxation on industry. Yet increasingly, the one percenters can be found in the ranks of government bureaucrats. Consider that the …

Mar 23

More cash-strapped Americans turn to tax refund advances

If you save anything in modern America, you are an utter fool. The Federal Reserve Bank has set interest rates at near zero for years now, and almost all of the world’s central banks are also pouring out paper currency at near-zero (or below-zero) interest rates. In the modern world–erected wholly upon a financing model …

Mar 19

Government Funding of Higher Education Takes Money from the Poor and Transfers it to the Rich

Why are taxpayers made to own or pay for government colleges and universities they do not attend? The only plausible explanation is that government-owned colleges somehow meet the needs of people in ways that private colleges do not. There is scant support for such a proposition. In fact, governmental support for higher education has actually …

Mar 18

Believe it or Not, Welfare Spending Harms the Poor

From Roger I. Roots, “When Laws Backfire: Unintended Consequences of Public Policy,” American Behavioral Scientist, Vol. 47 No. 11, July 2004, page 1382: The unintended costs of welfare spending have rarely been compiled by academics. But research has shown that a substantial number of welfare recipients simply live in poverty by choice because of the …

Mar 17

Milton Friedman on Social Security:

The U.S. Social Security program taxes most heavily on persons with low incomes, does not provide a fair return, and causes a massive transfer from the less well off to the better off. According to Milton and Rose Friedman, “the poor tend to pay [Social Security] taxes for more years and receive benefits for fewer …

Mar 17

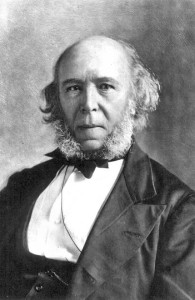

BRITISH MINIMUM WAGE ACT OF 1773 DROVE THE BRITISH TEXTILE INDUSTRY OVERSEAS AND DROVE COUNTLESS BRITS INTO POVERTY

Herbert Spencer, one of the founders of sociology, pointed out in 1850 that the British Minimum Wage Act of 1773—passed due to pressure from English weavers who believed the law would help lift textile workers out of poverty—decimated the British textile industry only 20 years later. By 1793, “some four thousand looms would be brought …