Author's posts

Mar 21

Decades of Extravagant Spending on Public Education Have Produced Few Good Results

Cato Institute’s Daniel Mitchell describes U.S. spending on public schools in this way: “Never Have so Many Paid so Much to Achieve so Little.” Incredibly, Americans are made to pay more for schooling than the parents of any other society. Yet American students–ranked head to head with students in other countries–perform very poorly. The graph …

Mar 21

Why do so many U.S. weapons fall into enemy hands? Will We Soon Be Attacked By Them?

Why do people who call themselves “conservatives” and who claim to advocate “limited government” worship big military? Former Congressman Ron Paul wonders why so many dollars worth of U.S. military weapons have supposedly fallen into the hands of “enemies.” “Building weapons and seeing them end up in the hands of the enemy is almost a …

Mar 20

Virtually all Manmade-Global-Warming Science–Almost All of Which Supports Expanding Government–Has Been Funded by Governments

According to the book “Merchants of Smear” by Russell Cook, the U.S. government alone spent more than $106 billion in taxpayer funds to research and support alarmist climate research between 2003 and 2010, as well as billions more on ineffective renewable energy boondoggles. Much of the taxpayer-supported alleged scientists refuse to let other scientists, IPCC …

Mar 20

A Private-Sector website that directed consumers to different health-insurance options already existed before the Obamacare website flop

Most of us remember two years ago when the government’s Obamacare website was launched. Americans watched in horror as the website crashed, failed to function and was hacked. At a cost to taxpayers of many tens if not hundreds of millions of dollars. It was a lesson in how government enterprises perform. Of course, ANY …

Mar 20

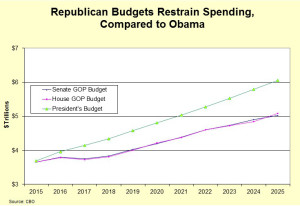

Congressional Republicans Introduce Proposed Budget that Increases Spending by at least 4 %; Democrats Cry that Republicans Intend to Slash Spending

If ever there were one graph showing how broken the U.S. government is, it is the graph above. The graph shows the current proposed Republican (“Grand Old Party”) budget in comparison to the Democrats’ suggested budget for the next decade. (Thanks to Daniel Mitchell of Townhall.com.) Both continue growing government significantly, however some economists hope …

Mar 19

Government Funding of Higher Education Takes Money from the Poor and Transfers it to the Rich

Why are taxpayers made to own or pay for government colleges and universities they do not attend? The only plausible explanation is that government-owned colleges somehow meet the needs of people in ways that private colleges do not. There is scant support for such a proposition. In fact, governmental support for higher education has actually …

Mar 18

Believe it or Not, Welfare Spending Harms the Poor

From Roger I. Roots, “When Laws Backfire: Unintended Consequences of Public Policy,” American Behavioral Scientist, Vol. 47 No. 11, July 2004, page 1382: The unintended costs of welfare spending have rarely been compiled by academics. But research has shown that a substantial number of welfare recipients simply live in poverty by choice because of the …

Mar 18

UNINTENDED CONSEQUENCES OF PUBLIC POLICY

In the words of the immortal Harry Browne, “Each government program carries within it the seeds of future programs that will be ‘needed’ to clean up the mess the first program creates.” (Why Government Doesn’t Work, 1995, p 17). Herbert Spencer remarked in 1850 that there was scarcely a bill introduced in the British Parliament …

Mar 18

Another town eliminates police force, finds that crime drops

The town of New Carlisle, Ohio–just outside Dayton–has eliminated its police force and cut its funding for county sheriffs deputies substantially. Just as with other towns who have done the same, crime has dropped.

Mar 17

Milton Friedman on Social Security:

The U.S. Social Security program taxes most heavily on persons with low incomes, does not provide a fair return, and causes a massive transfer from the less well off to the better off. According to Milton and Rose Friedman, “the poor tend to pay [Social Security] taxes for more years and receive benefits for fewer …