by Roger Roots,

Antigovernment News and Justice Travelers

Lower Manhattan, New York, Oct. 23.

Day 2 of the downsized “Exxon Knew” trial in lower Manhattan was much ado about meetings, phone calls, glossy reports and discussions among Exxon and some of its institutional investors.

ExxonMobil has long been a king of the New York Stock Exchange. As such it attracts huge institutional investors, such as the New York State pension funds, the Church of England and the California State pension funds. Some of these institutional investors love the steady growth, profits and dividends provided by Exxon but simultaneously claim to believe the world is speeding toward imminent calamity due to the burning of Exxon-provided fossil fuels.

As a direct result of shareholder demands, ExxonMobil has issued a few glossy reports about its positions on and preparations for climate change regulations.

These reports are now being used against ExxonMobil at a trial in the New York Supreme Court in lower Manhattan.

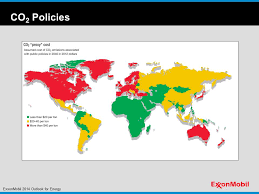

THE MAP

At issue in the trial are maps of the world found in some of Exxon’s glossy climate change reports. The maps show some countries in red, others in yellow, and others in green to designate projections of costs-per-ton of carbon production in the year 2040.

This is all speculation about future politics. No one in the world would make investment decisions based on such maps. But the New York Attorney General’s office is alleging Exxon committed securities fraud by them. (It doesn’t help ExxonMobil that the company at times offered different costs per ton of carbon by 2040 at different times or for different purposes.

Wednesday’s government witnesses included two representatives of institutional investor funds. The government led with Natasha Lamb of Arjuna Capital. Lamb claimed to be a concerned fund manager interested in making socially conscious investment decisions. Much of her testimony concerned what she “understood” from various exchanges with ExxonMobil representatives rather than what she directly read or heard from them.

On cross-examination, Lamb was exposed as a militant climate-change activist posing as a fund manager interested in investing in Exxon. She admitted she wrote anti-Exxon editorials and believed wholeheartedly in the “Merchants of Doubt” theory that Exxon had fiendishly concealed the dangers of climate change from the public. (Note that the downsized nature of the current “Exxon knew” trial stands as something of a repudiation of that very thesis, as the NY AG was unable to develop such a complaint after a 3-year investigation of ExxonMobil that produced some 4 million pages of corporate disclosures.) Natasha Lamb admitted that no statement by Exxon led her to make any investment decisions regarding Exxon stock.

The next witness was an assistant comptroller in the New York City pension fund office. Like Natasha Lamb before him, he claimed to be confused or tricked by ExxonMobil’s cost-per-ton projections. But he admitted on cross-examination that he never even saw Exxon’s colored map until preparing for this trial and that nothing said by ExxonMobil changed his assessment of ExxonMobil stock.

The government’s case is so apparently weak that by day’s end Wednesday, the government was seeking to introduce an email by Exxon’s lawyers during the midst of the 3-year investigation as proof of the meaning of the per-ton prices on the maps. The email exchange occurred at a time when ExxonMobil was being led to believe the investigation was about concealment of climate change science. Judge Barry Ostrager grumpily said he would consider whether to admit the email into evidence at a later time.

Trial continues on Thursday.