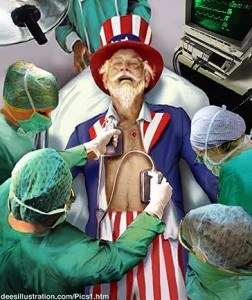

Socialism is a curse that should be wished only on a hated enemy. Any society that embraces it will inevitably become sick and weak.

The “Affordable Care Act” a.k.a. “Obamacare,” was some 2,000 pages in length when passed. Additional tens of thousands of pages of regs will ultimately accompany it.

Among the Act’s vast provisions is a section designed to equalize everybody’s health insurance by harshly taxing “Cadillac” (or luxury) health plans. Previously, some employers got a tax break by paying employees with fancy, all-inclusive, or “Cadillac” plans. Such plans provided all–or nearly all–health care for employees (who generally did not need even to pay a deductible when obtaining health care).

But Obamacare was drafted by minds that are fundamentally socialist; they resent the perks of the “affluent” and seek to equalize society. In the eyes of a socialist, everyone should get the same result no matter how hard they work or how much they provide.

Last week, the IRS issued a notice regarding “the excise tax on high-cost employer-sponsored health coverage under Code Sec. 4980I,” which will kick in beginning 2018. “Under Code Sec. 4980I [of Obamacare], if the aggregate cost of applicable employer-sponsored coverage provided to an employee exceeds a statutory dollar limit, which is adjusted annually, the excess benefit is subject to a 40 percent excise tax.” See here.

Stay tuned!