In a previous post, we alerted readers to a recent report that worldwide central banking has kept interest rates so artificially low for so long that “experts” now doubt whether central bankers can “fix” any future financial crisis. The Telegraph story is here.

The same report also warned that these artificially low interest rates have almost certainly caused a significant decline in general productivity across the world.

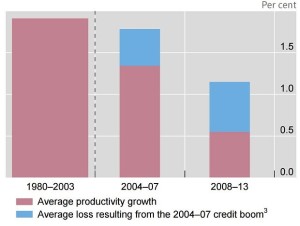

Study the chart above. Overall productivity in Europe traditionally grew at rates greater than one or two percent per year. (And growth rates were much higher in the U.S.)

After the recent financial crises, however, government-central bankers responded with lower-than-natural rates of interest on lending. This led to misallocation of business capital, lots of foolish business investment, lots more debt everywhere, and lots more government.

Now productivity growth rates are at or near zero-to-half-of-one-percent annually.

Europe is dying, killed by government and Keynsian economics.